liability liability low cost auto credit

liability liability low cost auto credit

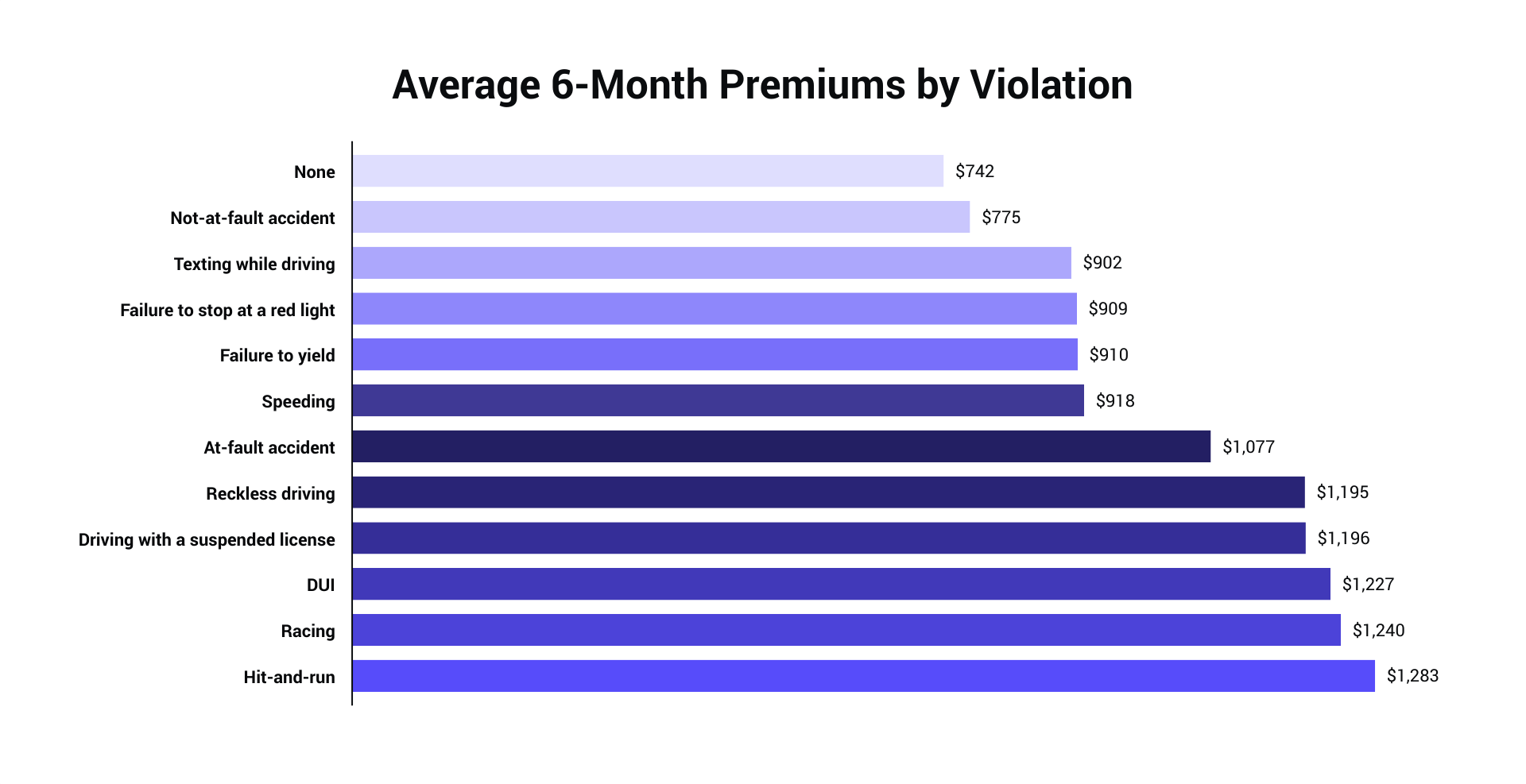

Driving Record, Tickets as well as various other violations can surge your car insurance coverage rate because they're an indication that you may be a risky driver - laws. Crashes, mainly when you're at mistake, can additionally create your costs prices to balloon. Sometimes, you can see a price boost after a crash also if you were not to blame for the mishap however still sued.

Vehicle Kind and Use, The kind of auto you drive is a key factor to consider for insurers. For instance, vehicles that are statistically much more most likely to be stolen may lug greater prices than others that are further down the list. And also the much more expensive the car, the more expensive the possible cases, which makes it more probable that you'll have a higher regular monthly costs.

Exactly how you utilize the vehicle is likewise crucial. You'll typically share just how lots of miles you anticipate to drive yearly and the key usage. For instance, if you have a lengthy commute, you might be most likely to obtain right into a mishap than a person who largely drives on the weekend breaks for pleasure (cars).

Demographics, Insurance carriers use a great deal of data to identify risk accounts, including demographics such as age, gender as well as marital status. Single men under 25 are the most likely to get in a mishap, and also they can anticipate their insurance policy prices to reflect that elevated degree of threat (accident).

Even where it's not needed, you have to give proof that you're monetarily furnished to pay for damages if you create a crash. business insurance. If your auto is funded, your lender may need you to carry a certain level of insurance policy over the legal minimum. If you obtain in a mishap where the various other party is at fault as well as they either don't have insurance or their responsibility defense is inadequate, this coverage kicks in to aid your plan bridge the gap.

This type of insurance policy is not available in all states., such as rental cars and truck repayment as well as emergency situation roadside help.

Other Elements, While not as noticeable in the choice, there are a number of various other variables that an insurance provider may consider when establishing your price, consisting of: Line of Click for more work, Housing circumstance, Previous insurance protection (particularly, whether there's been had a void in insurance coverage)Driving experience, Discount eligibility. risks.

Below are the state minimums for bodily injury and also residential or commercial property damages - money. Keep in mind that some states likewise require uninsured motorist bodily injury, without insurance motorist property damage, and also accident security insurance in addition to these minimums. See to it you comprehend your state's regulations and protection limitations before buying an auto insurance coverage.

$25,000/ $50,000 $10,000 West Virginia $25,000/ $50,000 $25,000 Wisconsin $25,000/ $50,000 $10,000 Wyoming $25,000/ $50,000 $20,000 1New Hampshire does not require its chauffeurs to lug automobile insurance, nonetheless, vehicle drivers must be able to cover the expense of building damage or bodily injury as an outcome of a mishap in which they are at fault - affordable car insurance.

Instance: If a tree branch falls on your vehicle throughout a tornado, extensive protection might cover the damage. Collision protection Crash insurance covers the price to repair or replace your very own car if you struck another lorry or item.

A Biased View of Car Insurance - Aaa Auto Insurance Quotes - Aaa Northern ...

A lot of states require you to lug liability insurance, however accident insurance is not needed by regulation - insurance affordable. If your vehicle is under a financing, however, it's common for lenders to need both detailed and also accident insurance coverage. Clinical payments Clinical coverage on a vehicle insurance plan covers you and any individual else in your lorry at the time of a crash.

When searching for auto insurance policy, check out the particular benefits each firm provides they may be well worth the included expense. What is a deductible? Deductibles are a typical attribute of insurance plan. A deductible is how much you need to pay of pocket before your insurance policy advantages begin.

For instance: If you pick a $500 deductible and get involved in a crash that needs $2,000 out of commission, you would pay the very first $500 as well as your insurance policy would certainly pay the continuing to be $1,500 (liability). If you have an accident with just $400 in damage, you would have to pay the entire expense, as it's reduced than the $500 insurance deductible.

Exactly how is automobile insurance policy priced? Car insurance policy prices are rather complex, yet it's simple to break down the numerous elements that identify your prices. Right here are a few of the major elements that go right into guaranteeing an auto as well as its driver: Motorist age: Younger motorists usually pay even more than older drivers - car insurance.

Driving history: If you have either a background of mishaps or tickets, you can anticipate to pay even more for insurance. Motorists with even more experience and a good record commonly obtain the most affordable prices. Motorist credit rating: Your credit report contributes in vehicle insurance rates. Drivers with higher credit rating scores normally obtain lower prices.

Some insurance providers use per-mile insurance policy where you pay less for driving much less. Marriage standing: Wedded drivers tend to be much less high-risk than songs. While the rate distinction is very little, wedded chauffeurs often tend to pay a little less. Insurance coverage selections: When you pick your deductible and insurance coverage degrees, your insurance policy premiums will rise or down with your choices.

The Facts About You Really Can Lower Your Car Insurance Cost - The New ... Uncovered

Somebody with an elegant new red sporting activities auto will probably pay a lot more than a similar motorist with a monotonous 10-year-old sedan. Discounts: Every insurer has its very own policies around discount rates. There are typical discount rates for several plans at the very same insurer, an excellent driving background, a reduced claim history, including car security and anti-theft attributes, automated payments, great pupils, and also others. credit score.

insured car vehicle auto affordable car insurance

Every insurance firm has its very own proprietary rates as well as formulas for deciding what clients pay (liability). Buying around can help you conserve a tiny fortune in many cases. If you can not manage vehicle insurance policy, you should not just drive without it, as it can be both unlawful as well as a huge danger to your financial resources.

An auto insurance coverage can include several different type of coverage. Your independent insurance coverage representative will certainly supply specialist recommendations on the kind as well as quantity of automobile insurance protection you need to have to meet your private needs as well as follow the laws of your state. Right here are the principal sort of insurance coverage that your plan might consist of: The minimal insurance coverage for bodily injury differs by state and also might be as low as $10,000 per individual or $20,000 per mishap.

If you hurt someone with your vehicle, you might be taken legal action against for a whole lot of cash. The quantity of Responsibility coverage you carry should be high adequate to shield your assets in case of an accident. A lot of experts recommend a limitation of a minimum of $100,000/$300,000, however that may not be enough.

cheapest car insurance risks cheaper auto insurance low-cost auto insurance

cheapest car insurance risks cheaper auto insurance low-cost auto insurance

If you have a million-dollar residence, you might lose it in a suit if your insurance policy protection is insufficient. You can get added insurance coverage with an Individual Umbrella or Individual Excess Liability plan. The greater the worth of your properties, the extra you stand to shed, so you require to purchase obligation insurance appropriate to the worth of your assets.

You do not have to figure out just how much to purchase that depends on the car(s) you insure. The higher the insurance deductible, the lower your costs will certainly be.

The Greatest Guide To Esurance Car Insurance Quotes & More

If the vehicle is only worth $1,000 and also the deductible is $500, it might not make good sense to get collision protection. Crash insurance coverage is not normally needed by state regulation. Covers the price of various damages to your cars and truck not triggered by an accident, such as fire and burglary. Just like Accident coverage, you require to pick a deductible.

Comprehensive protection is normally marketed with each other with Collision, and also both are commonly referred to together as Physical Damages coverage. If the cars and truck is leased or funded, the leasing business or loan provider may need you to have Physical Damages coverage, although the state legislation may not require it. cheaper. Covers the expense of healthcare for you and your travelers in the occasion of a crash.

Therefore, if you choose a $2,000 Medical Expense Limitation, each passenger will certainly have up to $2,000 protection for medical claims arising from a crash in your lorry (cheap). If you are entailed in a mishap as well as the other chauffeur is at mistake however has insufficient or no insurance, this covers the void between your costs and also the other motorist's coverage, up to the restrictions of your insurance coverage.